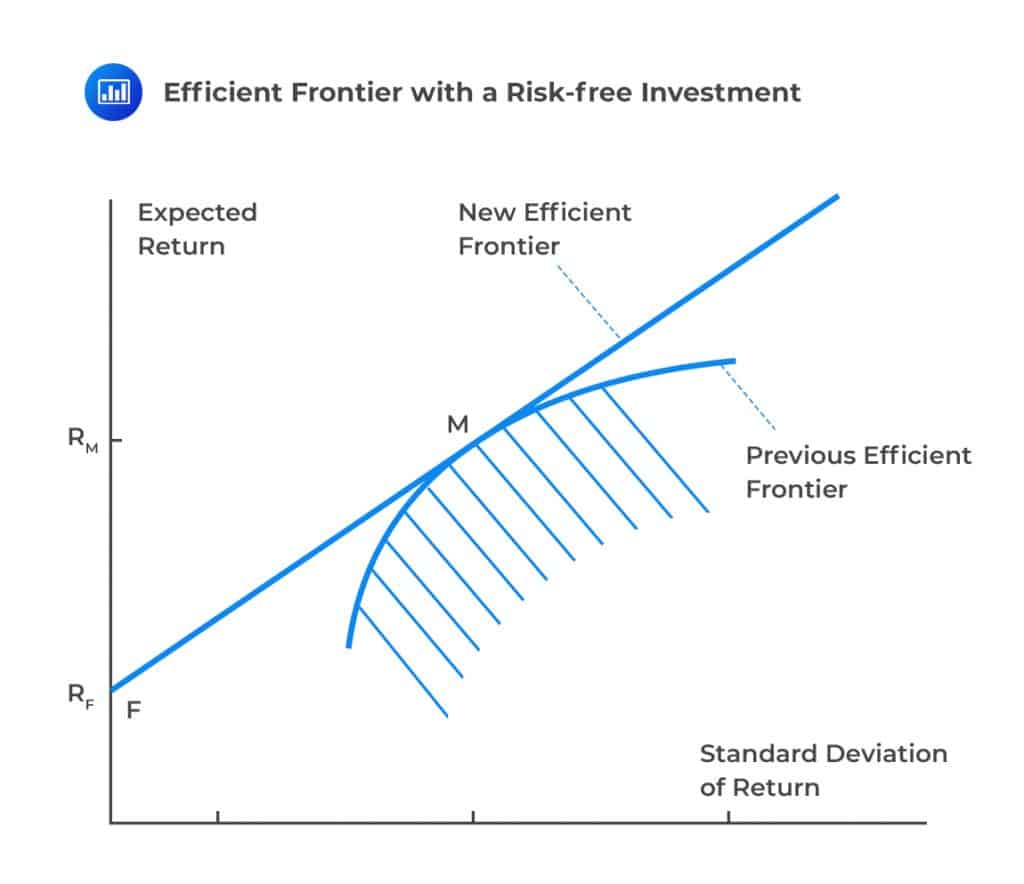

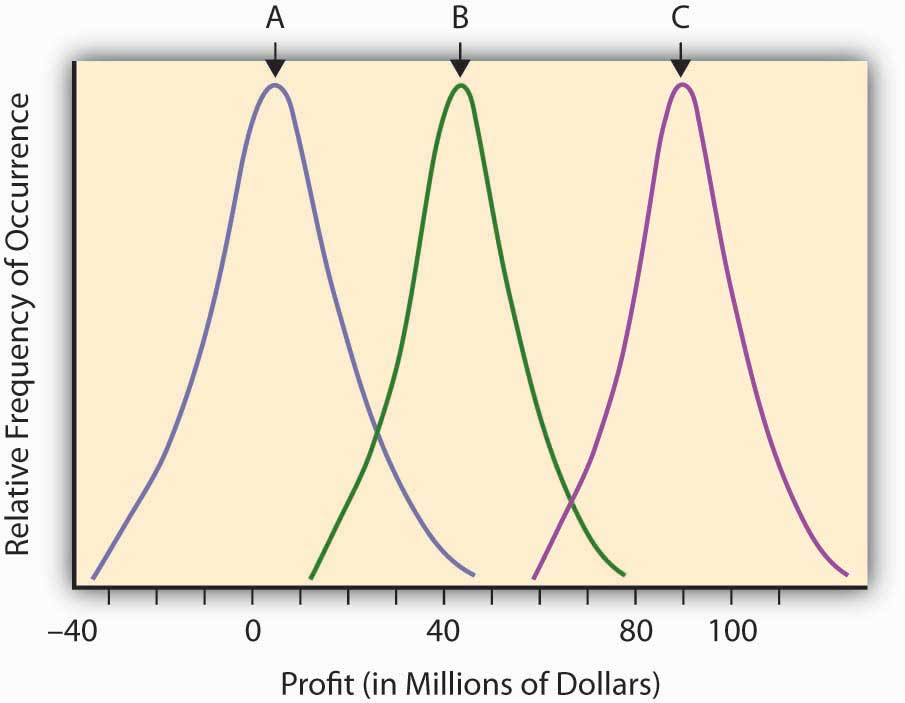

Alternative Measures of Risk. The Optimal Risk Measure Desirable Properties for Risk Measure A risk measure maps the whole distribution of one dollar. - ppt download

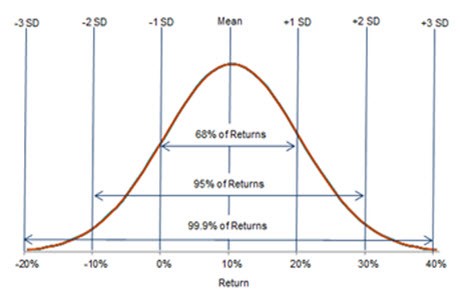

Standard Deviation, Probability, and Risk When Making Investment Decisions - Arbor Asset Allocation Model Portfolio (AAAMP) Value Blog

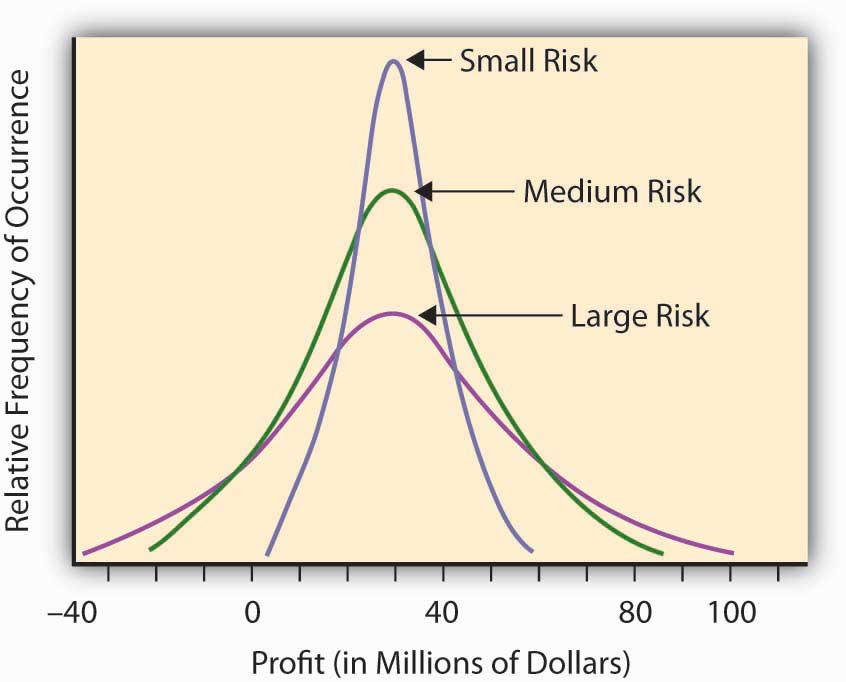

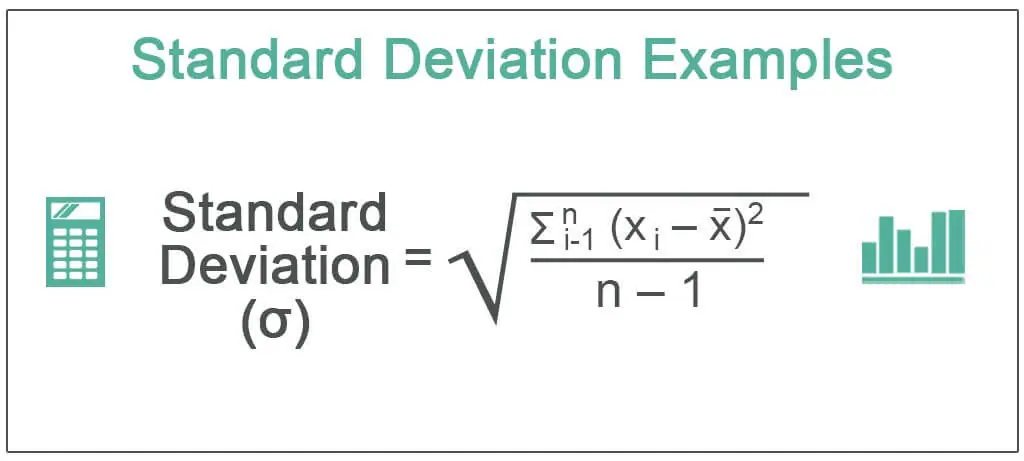

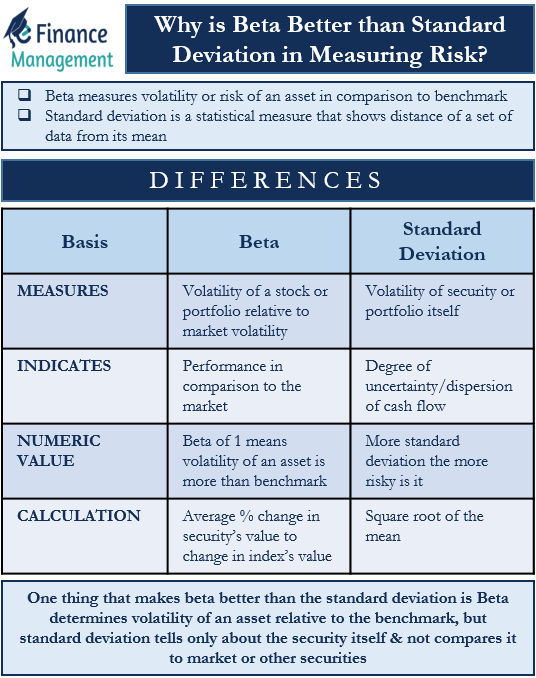

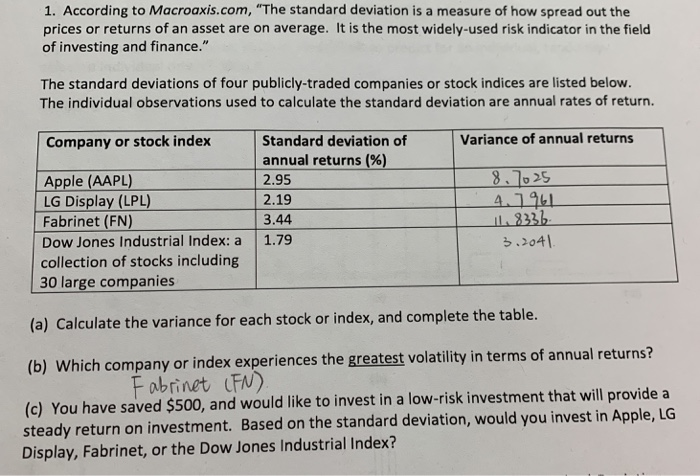

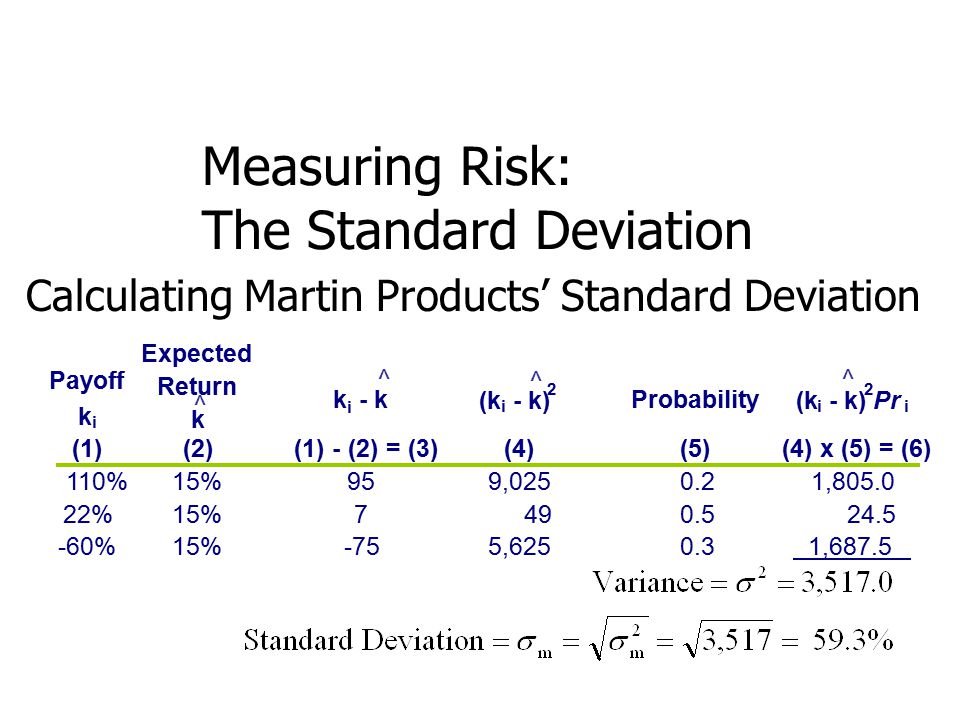

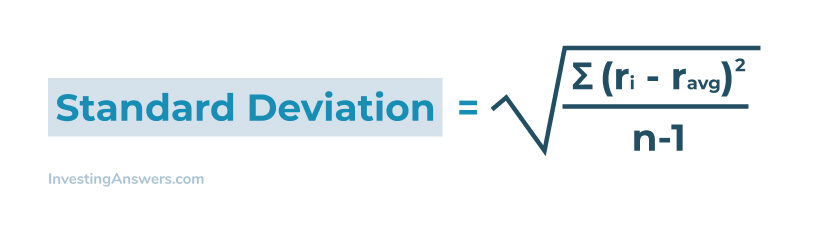

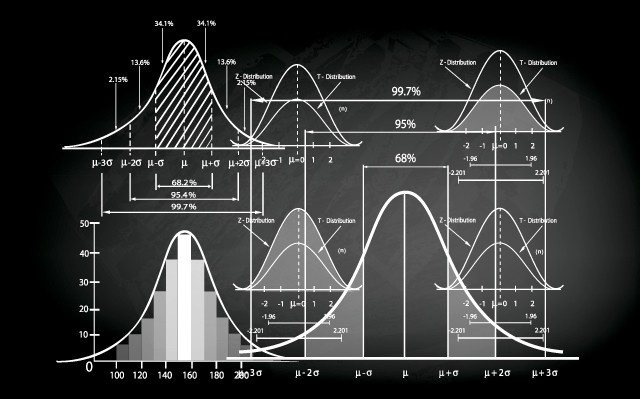

Standard deviation: A measure of risk based on how widely an asset's price fluctuates over a given period of time

:max_bytes(150000):strip_icc()/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

:max_bytes(150000):strip_icc()/Sharperatio-e93b773c49274c828f7508c79d4a18af.png)